| Dadim propaganda page |

|

Dadim stems from da, the mandarin pronunciation of ![]() meaning big, and dim which is short for

dimension. Dadim is a computational representation of high dimensional

functions. It is based on sparse grids, which were found by Smolyak to

store high dimensional data efficiently. Sparse grids have since been

further developed by Zenger and Griebel. Various implementations

showed the computational power and were often said to overcome the so

called "curse of dimension". It can therefore extend many well known

techniques, like wavelets and finite elements, to problems which can

today only be treated by random grids or Monte Carlo methods. Dadim

comes along with an implementation of several mathematical operators

which allow for differential analysis, solution of partial

differential equations and data compression. High dimensional

analysis can be employed in a wide range scientific disciplines. Below

there are some examples for an application in financial modeling.

meaning big, and dim which is short for

dimension. Dadim is a computational representation of high dimensional

functions. It is based on sparse grids, which were found by Smolyak to

store high dimensional data efficiently. Sparse grids have since been

further developed by Zenger and Griebel. Various implementations

showed the computational power and were often said to overcome the so

called "curse of dimension". It can therefore extend many well known

techniques, like wavelets and finite elements, to problems which can

today only be treated by random grids or Monte Carlo methods. Dadim

comes along with an implementation of several mathematical operators

which allow for differential analysis, solution of partial

differential equations and data compression. High dimensional

analysis can be employed in a wide range scientific disciplines. Below

there are some examples for an application in financial modeling.

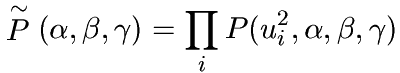

It is typically easier to introduce new parameters to a mathematical model, than to associate any market meaning with it or even to derive a specific value for it. Any additional degree of freedom increases the complexity of traditional algorithms exponentially. With Dadim it is possible to solve this high dimensional problem numerically and makes it more or less trivial to formulate the mathematical model and to compute a confidence interval together with a maximum likelihood estimate.

|

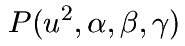

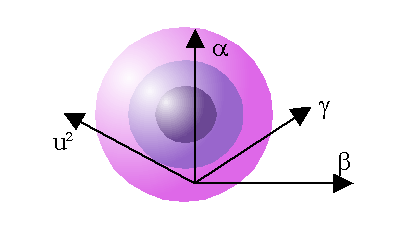

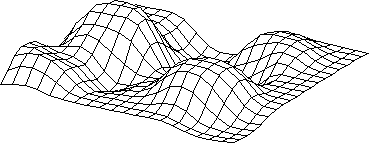

The GARCH model computes for

three parameters alpha, beta, gamma and a given history of price jumps

a volatility estimate, which is nothing else but a probability

distribution of u, the succeeding price jump.

|

|

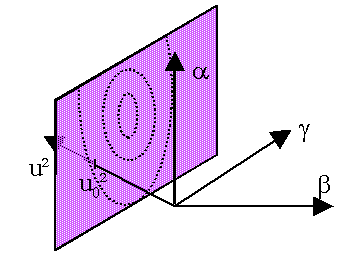

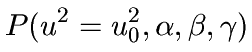

| At a certain time t0 there occurs a price jump

u0. This leads to probability distribution of the three

GARCH parameters.

|

| Assuming independence of all

price jump samples, one can obtain the joint distribution by

multiplying all individual distributions for different times

ti

|

|

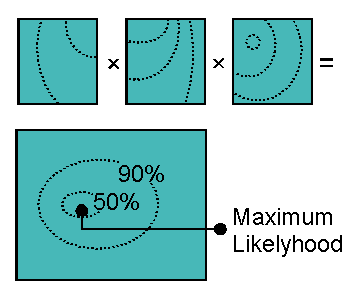

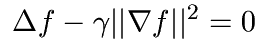

Numerical tasks often involve inter- and extrapolation of data samples. Since there rarely is a mathematically unique solution, one wishes to have tight control over the algorithms outcome and an intuitive configuration interface. Defining and solving a PDE associated with this problem has several advantages:

|

One of the most simple PDE is the Laplace equation, modeling a

trampoline being elevated at certain points.

| |

|

In order to avoid singularities at the sample points one can introduce

additional smoothness by considering the functions gradient.

|

| |

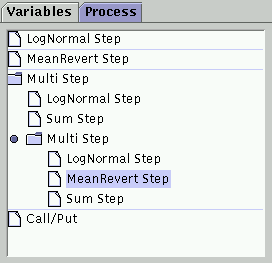

| Not feeling comfortable with the mathematical notation, one can use an XML editor featuring a tree structure and a more specific naming for different portions of an equation. |

|

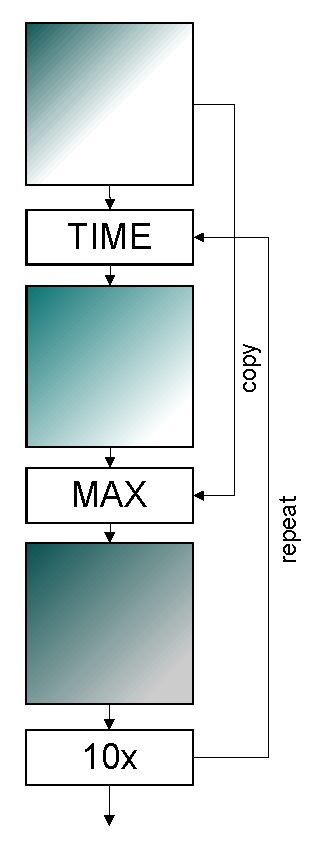

Nowadays, everyone can price exotic derivatives. So can Dadim. The goal of a PDE solver is to maximize computational speed, while keeping the pricing as configurable and open as possible. PDEs are capable of describing all kinds of Markov processes. Therefore they can easily be used for tasks done Monte Carlo or binomial tree implementations. The advantages of Dadim are higher speed, straight forward model fitting and unlimited configurability of the underlying formulas.

|

|